how far back does the irs go to collect back taxes

After that the debt is wiped clean from its books and the IRS writes it off. In most cases the IRS goes back about three years to audit taxes.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How far back does the IRS go to collect back taxes.

. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS. Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a. Can the IRS go back more than 10 years.

You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. Before starting this process call the IRS or a trusted tax professional. After the IRS determines that additional taxes are.

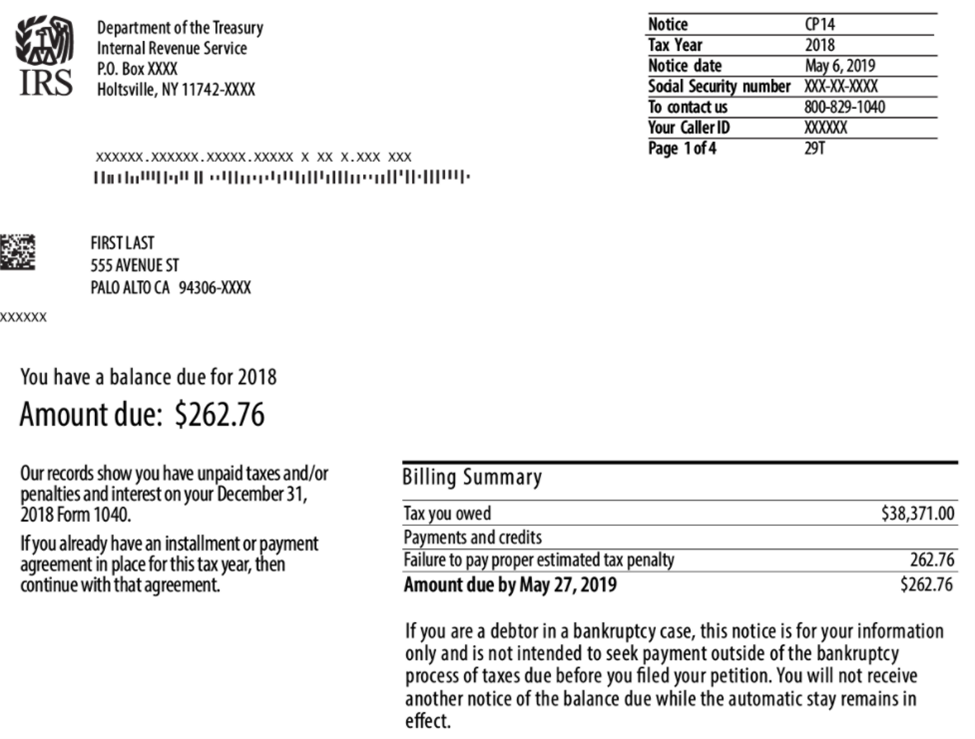

The IRS can go back up to. This means usually staying within the past two years for audits. To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account.

Theoretically back taxes fall off after 10 years. When it comes to IRS previous tax returns the agency says it tries to be fairly recent with its audits. This means that the IRS can attempt to collect your unpaid.

If we identify a substantial error we may add additional. The Statute of Limitations for Unfiled Taxes. Generally the IRS can include returns filed within the last three years in an audit.

An IRS Audit Can. IN GENERAL the IRS has 3 years from the date a return is. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

When the statute of limitations will expire or how far back the IRS can go depends on a number of variables. If the IRS goes back to collect on someones unfiled tax returns before they take the opportunity to rectify the problem they could face immense fees. 6 Years for Filing Back Taxes 3 Years To Claim a Refund.

How Many Years Can The Irs Collect Back Taxes. Only Go Back Six Years. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Confirm with them that you only have to go back as far as the past six years for. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. As a general rule there is a ten year statute of limitations on IRS collections.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The IRS 10 year statute of limitations starts on the day that your.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23947339/1221422461.jpg)

Is The Irs Really Hiring 87 000 New Auditors No It Isn T Vox

How Long Does The Irs Have To Collect Back Taxes Brinen Associates

Column The Irs Hired Bill Collectors To Collect Back Taxes And Got Ripped Off Los Angeles Times

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

Are There Statute Of Limitations For Irs Collections Brotman Law

Gop Irs Coming To Get North Carolinians Unless Republicans Win Back The House The North State Journal

How To Stop Irs Minnesota Revenue From Collecting Back Taxes Southwest Minneapolis Mn Patch

Can Irs Collect After 10 Years 10 Year Statute Of Limitations Irs

What To Do If Your Tax Refund Is Wrong

Why Irs 80b Expansion Is A Nightmare For Small Business

Banks Battle Against Irs Reporting Isn T Over American Banker

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

Owe Back Taxes The Irs May Grant You Uncollectible Status

How Many Years Does The Irs Go Back To Collect On Unfiled Tax Returns Mod Ventures Llc

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

How Long Can The Irs Attempt To Collect Unpaid Taxes

Irs Debt 5 Ways To Pay Off Landmark Tax Group

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service